Rent, Responsibility, or Resentment? Navigating Family Dynamics When You’re Asked to Pay Too Much

At 22, you’ve wrapped up your apprenticeship, finally stepping into a stable career path. Your boyfriend’s got a well-paid internship too, so yeah—financial independence is actually within reach. But just as things are starting to look up, your parents hit you with a demand: pay €900 in rent plus around €400 in utilities every single month… for a house that’s falling apart, a place you’ve already poured time and money into fixing.

Advertisement – Continue Reading Below

And here’s the kicker—your brother, who earns more than both of you combined, pays absolutely nothing. Not a single euro toward housing costs or household expenses. Meanwhile, you’re not just covering utilities—you’re also handling repairs, upkeep, and even chopping wood for heating in winter. It feels less like “fair contribution” and more like you’re funding someone else’s investment property while being treated like free labor.

So you decide the smartest move—the only move, really—is to step away. Choosing to move out isn’t about running away from family, it’s about valuing yourself, your hard-earned money, and your emotional health. But of course, instead of support, you get slammed with guilt trips. Suddenly you’re “ungrateful” and “betraying” your parents because you don’t want to throw your entire paycheck into unfair rental costs.

Advertisement – Continue Reading Below

Here’s the reality though: wanting out of a toxic financial arrangement doesn’t make you ungrateful—it makes you smart. You don’t “owe” anyone your income just because they’re family, especially when the arrangement is one-sided and draining. Walking away from an unfair deal is actually a step toward better money management, lower stress, and long-term stability.

💡 Bottom line? You’re not selfish for choosing independence—you’re protecting your financial future and your emotional well-being.

You’re asking: Am I in the wrong?

Advertisement – Continue Reading Below

When parents pressure their kids to repay them for everything they have done, it can severely damage their relationship

The poster shared that she and her boyfriend had been living in her parents’ house, paying around €500 as rent, and her brother stayed there rent-free

The Real Talk on Parents Charging Rent: Fair Contribution or Exploitation?

Let’s be honest—money and family don’t always mix well. Especially when it comes to adult children paying rent at home. Some say it teaches responsibility, others argue it’s unfair. And when parents start asking for over €1,000 a month plus utilities in a house that’s falling apart? Yeah, that hits a whole different level of financial stress. Let’s break it down.

1. Contemporary Expectations of “Fair Contribution”

There’s no universal rulebook for this stuff. But in most households, once you’re done with school and actually working, people agree you should chip in. Still, the “fair share” is usually modest—not market-rate.

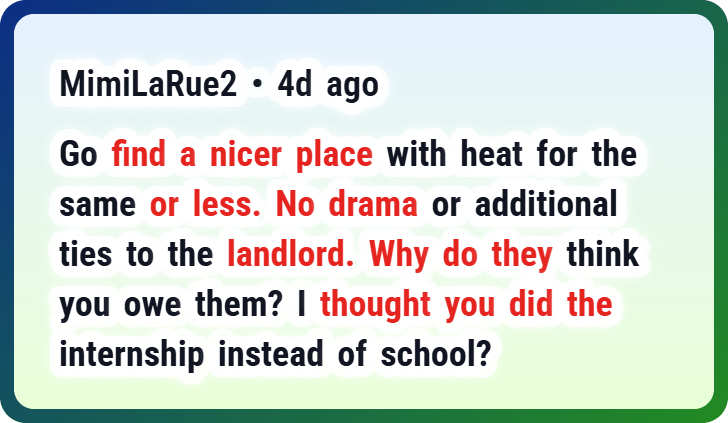

One Redditor summed it up perfectly:

Advertisement – Continue Reading Below

“I’d probably just charge utilities… or no more than 30% of their income.”

That feels reasonable, right? Covering basic utilities like gas, electricity, and water keeps things fair without draining your paycheck. A lot of parents see this as teaching money management skills without turning their kid into a tenant.

But then there are families who push it way too far. Some even ask for full rent prices, which a lot of people say destroys the whole idea of family support:

“Charging your children rent doesn’t add up… It’s not helpful.”

In other words, yes, contributing is fair. But if your parents are charging you like a landlord, while you’re also covering home repairs and utilities, that’s not financial fairness—that’s exploitation.

Advertisement – Continue Reading Below

💡 Insight: A healthy arrangement usually means a small, symbolic contribution. What you’re describing is way past the line—especially since your brother lives rent-free.

2. The “Pay-and-Stay” Trade: Equity or Exploitation?

Another hot debate: if you’re paying rent at home, should you still be doing chores, repairs, and maintenance? A lot of young adults argue no:

“Once I’m paying rent, I’m not doing them. She called me ungrateful.”

Sound familiar? You’re paying over €1,300 monthly for a house with no heating, busted floors, and plumbing you had to fix yourself. That’s not “family help”—that’s you funding an investment property your parents own. Meanwhile, your brother contributes nothing.

Advertisement – Continue Reading Below

This creates two major problems:

- Financial burden: Covering rent plus utilities in a house with subpar living conditions.

- Emotional inequity: Being treated unfairly compared to your sibling builds resentment.

Imagine paying rent to a landlord and then being told to redo the floors or burn wood for heating in winter. You wouldn’t accept that deal from a stranger—so why accept it from family?

💡 Insight: Paying something fair = okay. Paying everything and working like free labor = exploitation.

Advertisement – Continue Reading Below

3. Family Theory vs. Practical Reality

Some families handle this well. A parent might ask for small rent, then secretly save it to give back later as a nest egg for buying a first home. That’s actually pretty thoughtful—it teaches budgeting without draining the kid’s future.

But in your case, there’s no sign of that. The money you’re paying goes straight into maintaining their house. That means you’re investing in their asset, not yours.

This is where personal finance and family boundaries collide. Helping out is one thing. But being locked into a bad housing market situation where your contributions don’t benefit you? That’s just losing money and time.

Advertisement – Continue Reading Below

💡 Insight: If you’re not building savings or equity, you’re essentially paying for someone else’s financial gain.

4. Cultural Context and Emotional Costs

Parents love to frame this as “payback” for raising you. That whole “we sacrificed for you, now it’s your turn” guilt trip. And sure, gratitude matters. But it completely ignores the emotional labor and financial support you already gave.

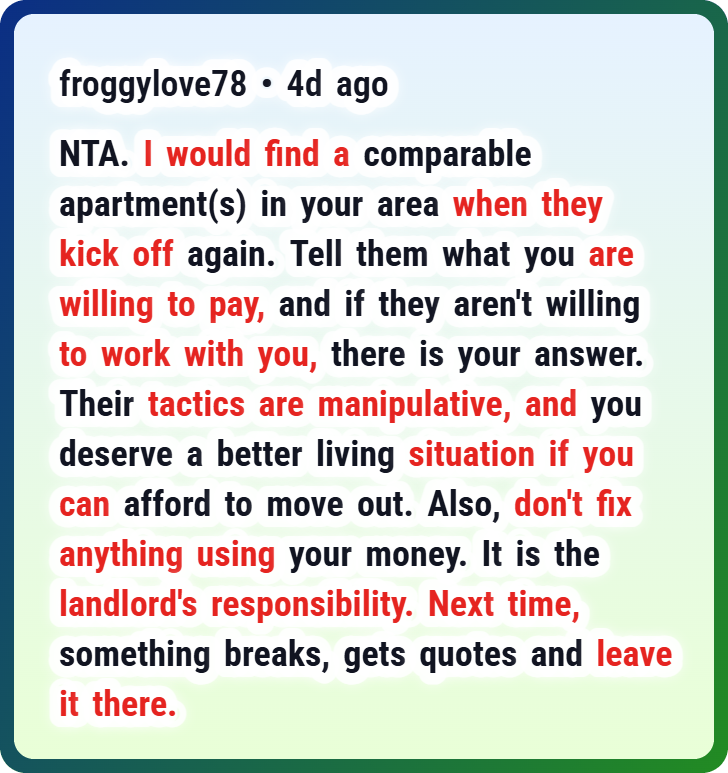

Calling you “ungrateful” just because you want independence is manipulative. And here’s the thing: most people online encourage moving out as soon as it makes sense. One common piece of advice?

Advertisement – Continue Reading Below

“Stay calm, start looking for a new place. You deserve to be independent.”

Moving out isn’t betrayal—it’s self-respect. And in reality, housing independence is healthier for both sides. You’ll feel less stressed, and your parents will eventually have to confront their own money management habits instead of leaning on you.

💡 Insight: Guilt should never replace fairness. Independence isn’t ungrateful—it’s survival.

5. Legal Frameworks & Practical Steps

Okay, let’s get practical. Not legal advice, but here’s the gist:

Advertisement – Continue Reading Below

- You’re not legally obligated to pay rent to your parents unless you signed something.

- Tenant rights don’t usually apply if there’s no formal rental agreement.

- If families want fairness, they should set clear, written terms about rent, utilities, and responsibilities.

Many parents who charge rent but want to be fair treat it like forced savings—later giving it back as down payment help. That’s transparent. But in your case? No agreement, no savings, no fairness.

At this point, boundaries are essential. Start looking for your own place, even if it’s small. Budget wisely, use money-saving tips, and get into a situation where your contributions actually benefit you.

💡 Insight: Without clarity, you’re basically stuck in a one-sided deal. Moving out protects both your finances and your emotional health.

Advertisement – Continue Reading Below

6. Final Judgment: You’re Not in the Wrong

Bottom line? You’re not wrong for wanting out. Paying a small share at home is fine. But what’s happening here—high rent, unfair treatment compared to your brother, plus guilt tactics—isn’t okay.

The Reddit consensus is clear: set boundaries, move toward independence, and don’t let guilt control your decisions. You’re not ungrateful for wanting fairness—you’re simply valuing yourself.

💬 Takeaway: A “fair contribution” should help you grow, not drain your bank account or emotional well-being. When it becomes one-sided, the healthiest move is to step out and build your own future.

Advertisement – Continue Reading Below

✨ Final Thoughts: Families can absolutely support each other financially—but only when it’s balanced and respectful. Asking for a little rent? Fine. Demanding market-level payments in a rundown home while playing favorites? That’s not parenting, that’s bad property management. Trust your gut—it’s time to prioritize your financial health and emotional independence.

Most folks urged the woman to move out and told her that her parents were being extremely greedy and using her